Inside LOOK: Multifamily Syndications

According to CBRE, over $100 billion in multifamily loans come due by 2026.

Most owners are over-leveraged and under-prepared for that reset.

For disciplined investors, that’s not risk, it’s rotation.

Value-add syndications are quietly shifting from chasing yield to capturing opportunity.

According to CBRE, more than $100 billion in multifamily loans will mature in 2025 and 2026. For over-leveraged owners, that’s pressure — for patient investors, it’s opportunity. That looming debt wall is reshaping the landscape, setting the stage for disciplined, well-structured value-add apartment projects to shine again.

This Inside Look decodes how these private placements actually function — their history, their mechanics, and what it feels like to participate as an investor. By the end, you’ll see through the spreadsheets the way insiders do.

How We Got Here, From Country Club Deals to Crowdfunded Syndications

Before 2012, investing in private apartment deals was invitation-only. These “country-club syndications” lived in a quiet corner of the market, governed by older versions of SEC Regulation D Regulation D (Reg D) — an SEC exemption that allows private companies to raise capital from accredited investors without a full public registration. . Sponsors could only raise capital through personal relationships, no advertising, no websites, no LinkedIn posts. It was like a high-stakes poker game: if you weren’t already at the table, you didn’t even know the game was happening.

Then came the JOBS Act, signed by President Obama. For the first time, sponsors could publicly market private offerings to accredited investors, provided they verified accreditation. That single rule change opened the door to online platforms and made private placements discoverable instead of secret.

By 2016, a wave of real-estate entrepreneurs flooded in. Multifamily properties became the go-to because they were tangible, understandable, and scalable. If you noticed that everyone on investing podcasts between 2017 and 2022 seemed to be “raising for apartments,” that’s why, the floodgates opened.

Then the cycle turned. Interest rates doubled inside 18 months, tightening cash flow and slowing refinances. The fundamentals of housing demand stayed intact, but the era of easy money ended. Now, as rates stabilize, seasoned operators with patient capital are finding opportunity in that reset.

“Understanding this timeline isn’t trivia, it’s insight. It shows why today’s syndications are structured the way they are.”

Every syndication follows the same six-step rhythm, capital in, value out. It’s not theory; it’s process. Once you understand the flow, you can instantly see where risk, return, and control live inside any private deal.

The Six Phases of a Value-Add Multifamily Syndication

Capital → Acquire → Operate → Improve → Refinance / Distribute → Exit

“It’s not a flip, it’s a system. Once you see the steps, you’ll never mistake motion for progress again.”

Each phase unfolds over time, not overnight. In a typical 5–7 year hold, capital enters early, operations and improvements carry the middle innings, and distributions begin once stability returns. The refinance often lands around year three, the exit near year five or beyond.

Once you understand the rhythm, the next question naturally comes up: What separates a disciplined sponsor from a careless one? That’s where structure and alignment show up right here in the fine print.

Now that you know what a sound deal looks like, let’s follow the money. Once the capital lands, the paperwork takes over, and that’s where the real story begins.

Once capital is raised, funds are wired into the project’s operating account. This is where three legal documents appear:

Private Placement Memorandum (PPM)

The disclosure book explaining the deal and its risks.

Subscription Agreement

Your signed commitment confirming accreditation and investment amount.

Operating Agreement

The rulebook defining profit splits, voting rights, and reporting cadence.

Together, these documents define the rules of engagement: how profits flow, how risks are shared, and how communication stays transparent. They’re not just legal forms; they’re the foundation of trust.

“If you’ve ever opened one of these PDFs and thought ‘this reads like it was written for lawyers,’ you’re right. but the investors who understand how to read them have the advantage.””

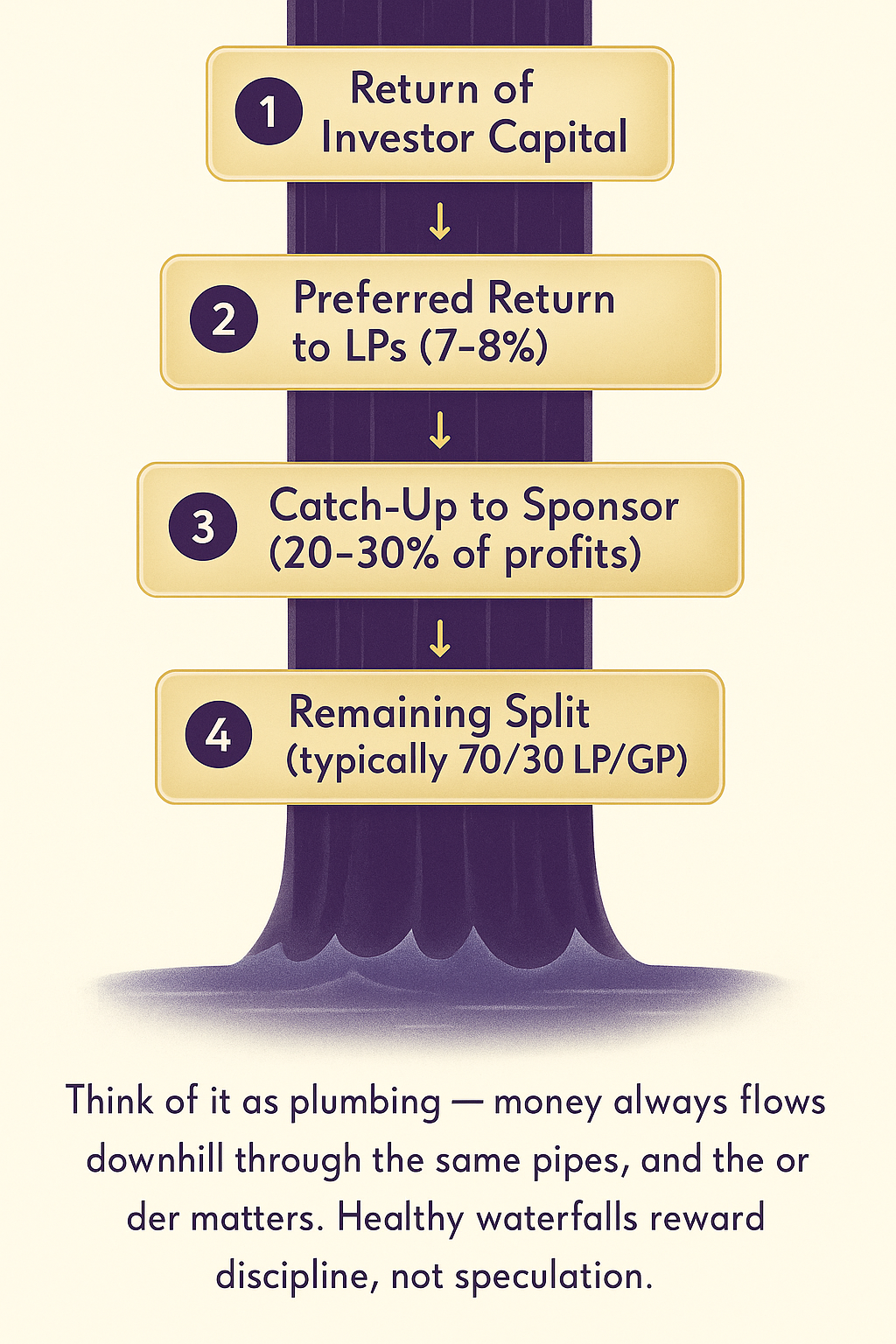

Once the timeline plays out, the real choreography begins, the flow of money back through the system. Distributions don’t just appear; they follow a disciplined sequence called the waterfall.

Fast forward to the finish line. The renovations are complete, rents have stabilized, and the property is either refinanced or sold. What happens next is the part every investor leans in for, the distribution of profits. This is where years of work convert back into cash flow, following a precise order of operations known as the waterfall.

The Waterfall - How Cash Flows Back

The waterfall shows how returns are split, but returns only matter if the deal itself is sound. That’s where the five core metrics come in the indicators seasoned investors check before wiring a dollar.

The Five Vital Signs

Vital Signs: The Five Metrics Every Investor Should Master

Every private deal, no matter how complex it looks, runs on the same handful of numbers. Think of these as the vital signs of an investment — the five indicators that reveal whether a deal is healthy, overleveraged, or worth walking away from. Once you can read these, you’ll see through 90 % of the noise in any offering.

Cap Rate

Net Operating Income ÷ Purchase Price. Shows yield on a cash purchase. Higher cap rates mean more risk; lower rates signal tighter markets.

NOI (Net Operating Income)

Revenue minus operating expenses. Everything above this line is operations; everything below it is financing.

DSCR (Debt Service Coverage Ratio)

NOI ÷ Annual Debt Service. Lenders want 1.25× or better — that’s your cushion between income and loan payments.

CoC (Cash-on-Cash Return)

Annual Cash Flow ÷ Equity Invested. Invest $100 K and receive $8 K per year = 8 %. It’s the yield you actually feel.

IRR (Internal Rate of Return)

Total profit over time, expressed as an annualized percentage. The faster the capital cycles back, the higher the IRR.

“If you understand these five, you can read nearly any deal on your own. That’s the cheat code.”

How Value-Add Creates “Forced Appreciation”

Home values rise with comps; apartment values rise with income. When a sponsor renovates units and raises rents by $100, that extra income boosts NOI. Apply a market cap rate to that new NOI, and you’ve created what’s called forced appreciation Value growth created by improving a property’s income and operations rather than waiting for market inflation. .

Small operational tweaks, rents, utilities, management efficiency, can add millions in equity value. Discipline creates the upside; luck just takes the credit.

Example: How a $100 Rent Increase Drives Millions in Value

Let’s put numbers behind the concept. Imagine a 200-unit apartment community where each unit rents for $1,200 per month. After renovations and upgrades, rents rise by $100 per unit. That doesn’t sound huge — until you see what it does to the property’s Net Operating Income (NOI) and market value.

Before Renovation

- Units: 200

- Avg Rent: $1,200 / month

- Annual Gross Income: $2,880,000

- Operating Expenses: $1,150,000

- NOI: $1,730,000

- Value @ 6% Cap: ≈ $28.8M

After $100 Rent Bump

- Units: 200

- Avg Rent: $1,300 / month

- Annual Gross Income: $3,120,000

- Operating Expenses: $1,150,000

- New NOI: $1,970,000

- Value @ 6% Cap: ≈ $32.8M

That extra $100 per unit per month increased NOI by $240,000 a year — which at a 6% cap rate translates into roughly $4 million of new equity value. That’s the power of forced appreciation: income multiplied by market efficiency.

“Every dollar of new annual income adds about $16 of property value at a 6% cap rate. That’s how operational skill becomes equity growth.”

Leverage and Safety Margin

That’s how value is created, but the other side of the equation is how it’s protected. The same leverage that amplifies gains can also magnify mistakes if debt terms are too aggressive or coverage is too thin. That’s why experienced operators don’t just chase returns; they underwrite resilience.

Before wiring capital into any deal, it’s worth checking the three pressure points that determine whether a project can ride out rate shocks, renovation delays, or rent softening. Think of these as the balance metrics what you should look for, and what should set off alarms.

The next lever in real estate investing isn’t about operations, it’s about how the tax code treats those operations. For nearly a century, U.S. tax policy has been written to incentivize behaviors that build housing, create jobs, and circulate private capital. That’s why investors who fund these projects receive benefits that ordinary stockholders don’t.

When you invest in a private real estate placement, you’re not gaming the system, you’re participating in the system as it was designed. The IRS views property ownership as a public good: it provides housing, stabilizes communities, and employs trades. So instead of taxing it harshly, the code rewards it through tools like depreciation, cost segregation, and 1031 exchanges.

The wealthy didn’t invent those advantages, they simply learned to use them. Once you understand how the incentives work, you start to see real estate less as a transaction and more as a framework for building lasting wealth within the rules.

Tax Angle 1: Depreciation as a Wealth Tool

Owning a fractional interest in the asset means you also own a fraction of its depreciation A non-cash expense the IRS allows to offset income for a building’s gradual wear. . A K-1 may show a loss even while you’re receiving cash flow—a rare, perfectly legal tax advantage.

In 2025, Congress reinstated accelerated depreciation, letting operators front-load that benefit through a cost-segregation study. It’s the difference between waiting 27 years and claiming deductions up front.

“Most investors smile when they realize they can collect cash flow and still report a paper loss.”

Tax Angle 2: 1031 Exchanges

A 1031 Exchange A mechanism that lets investors roll gains from one property into another like-kind asset without immediate capital-gains tax. allows investors to keep equity compounding instead of sending a check to the IRS. Some apartment syndications can accept 1031 funds, making them a natural landing spot for owners who’ve just sold property.

Quick Comparison: REITs vs Private LP Ownership

When you buy a public REIT, you own a company that owns real estate. When you invest as an LP in a private placement, you own a fraction of the property itself. That distinction matters because direct ownership passes through depreciation and passive-loss benefits—advantages REIT shareholders never see.

REIT dividends are taxed as ordinary income. LP distributions are often sheltered by depreciation. Same property type, completely different after-tax outcome. The most strategic investors use both: liquidity on Wall Street, tax efficiency on Main Street.

The Takeaway: What the Current Cycle Is Really Signaling

After years of easy money and compressed cap rates, 2025 marks a reset. Financing has tightened, underwriting standards are rising, and investors are asking sharper questions. That’s a healthy correction, it’s bringing the focus back to fundamentals: cash flow, capable management, and disciplined execution. When those three align, value-add projects still make sense.

The model itself hasn’t failed—the market simply stopped rewarding shortcuts. Operators who communicate clearly, manage debt conservatively, and underwrite to real numbers are regaining the trust that fast-growth strategies eroded. Multifamily remains a foundational segment because it’s understandable, cash-flow driven, and grounded in physical assets investors can analyze and measure.

“Education is the new edge. Once you understand how these structures actually work, you stop chasing returns and start recognizing alignment.”

Where This Fits in a Portfolio

For many investors, apartment syndications fill the middle lane between volatile equities and illiquid alternatives. They can produce steady income, meaningful tax shelter, and moderate appreciation; a practical bridge between growth and preservation. Think of them as the income engine that lets the rest of your portfolio take calculated risks.

Real-estate cash flow isn’t a get-rich-quick plan; it’s a stay-rich-long-enough plan. That mindset is what separates people who ride cycles from those who get caught by them.

Some Final Words

If this breakdown gave you a clearer picture of how apartment private placements actually work, that was the goal. The next time you see one of these offerings, you’ll understand the moving parts and you’ll know what questions to ask. If you ever run across a deal and want a friendly second opinion, or you’d like to see how I’m approaching this model in today’s market, feel free to reach out.

Footnote — Educational & Compliance

This educational content is designed for sophisticated and accredited investors seeking to understand private-market structures. It is not an offer to buy or sell securities. Always conduct your own due diligence or consult a licensed advisor before investing. All examples are hypothetical and provided for illustrative purposes only.