Sale-Leasebacks: The Cash Flow Most Investors Never See

Operating companies execute tens of billions of dollars in sale-leaseback transactions every year, converting owned facilities into growth capital while continuing to operate as usual.

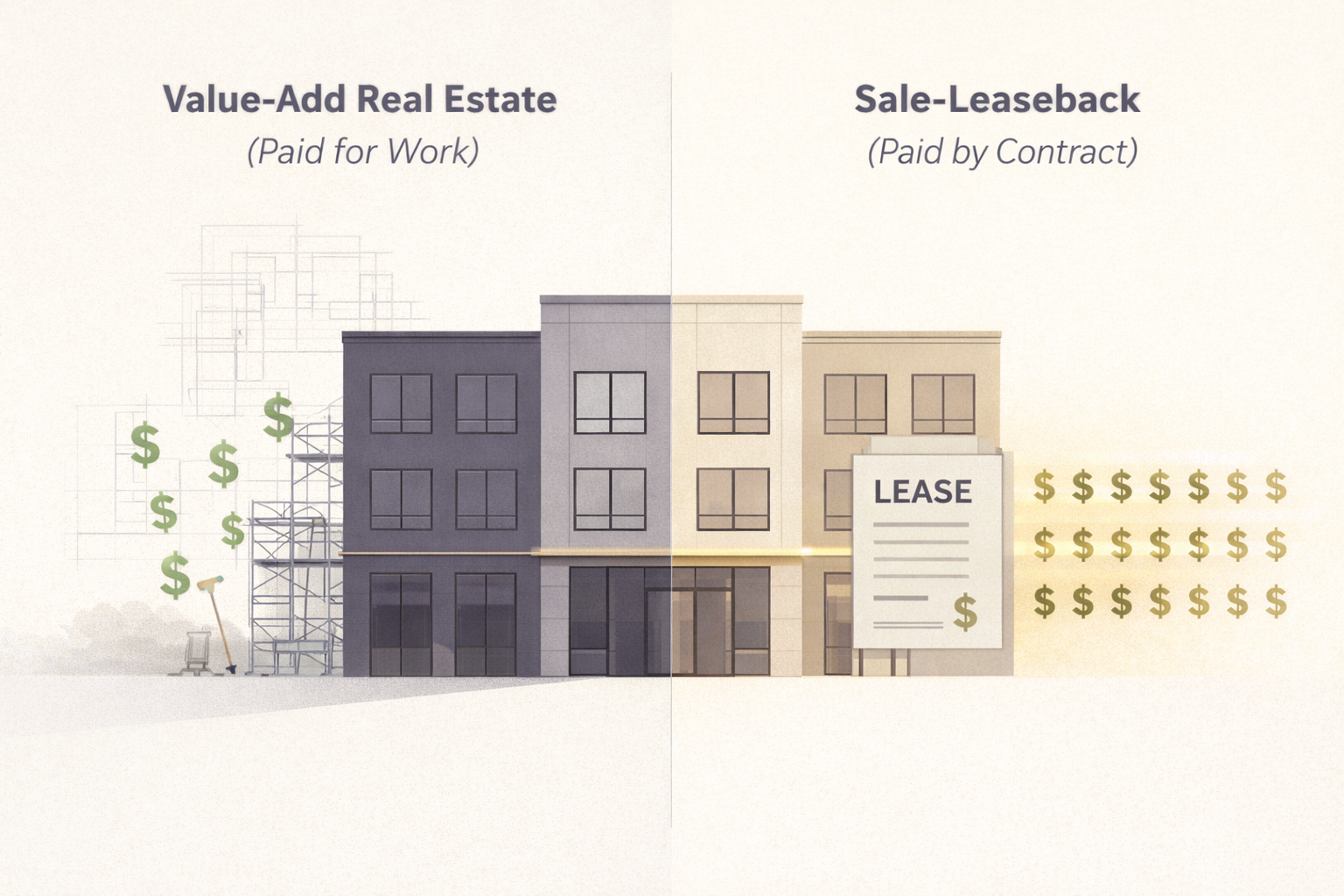

Yet most individual investors never see this model . . . because they’re trained to think real estate returns come from renovations, lease-ups, and perfect exits.

When “Doing More” Becomes the Risk

Most real estate strategies reward activity.

Buy. Renovate. Re-tenant. Refinance. Exit.

The upside looks compelling, until execution risk piles up. Construction delays. Cap-rate expansion. Floating rate debt. Paused distributions.

At some point, investors stop asking how much upside is possible and start asking a quieter question:

How much of this actually needs to go right?

That’s where sale-leasebacks enter the conversation. Because the “engine” is different…

A Different Way to Think About Real Estate Income

A sale-leaseback isn’t a property strategy. It’s a capital strategy.

An operating business sells a facility it already owns, then immediately leases it back under a long-term contract.

Ownership Changes. Operations Don’t.

Becomes tenant

Becomes landlord

Here’s the key distinction: sale-leaseback describes the transaction. The lease describes the income behavior that follows.

And in many deals, that lease is structured to behave like a utility bill: the tenant pays the operating costs… and the landlord collects rent.

Next question is obvious: what kind of lease does that usually look like?

Get Back9 Signals →

What the Lease Often Looks Like After the Sale

In many sale-leasebacks, the operating business signs a triple-net (NNN) lease.

The tenant pays the operating costs:

- Property taxes

- Insurance

- Maintenance / repairs

This is why the cash flow can feel “boring” in the best way, and why underwriting focuses less on renovations… and more on one thing: tenant strength.

Same Asset Class. Different Engine.

On paper, sale-leasebacks and multifamily deals can look similar. But the engines are different.

Return driver: operational transformation

Risk: execution, timeline, exit pricing

Return driver: contractual rent

Risk: tenant credit, re-tenanting realism

The trade-off is real: slightly lower upside, significantly higher day-one predictability. And that raises the real teaser question… how do experienced sponsors underwrite that risk?

Sale-leasebacks don’t eliminate risk, they relocate it into contracts.

If you want to understand the math, underwriting pillars, and how these structures compare to traditional syndications, our Inside L00K breaks it down line by line.

If you’d rather compare notes first, we can talk it through.

This article is for educational purposes only and does not constitute investment advice or an offer to sell securities.